GOP Tax Law

Republican Tax Law Shortchanges Workers & Our Economy

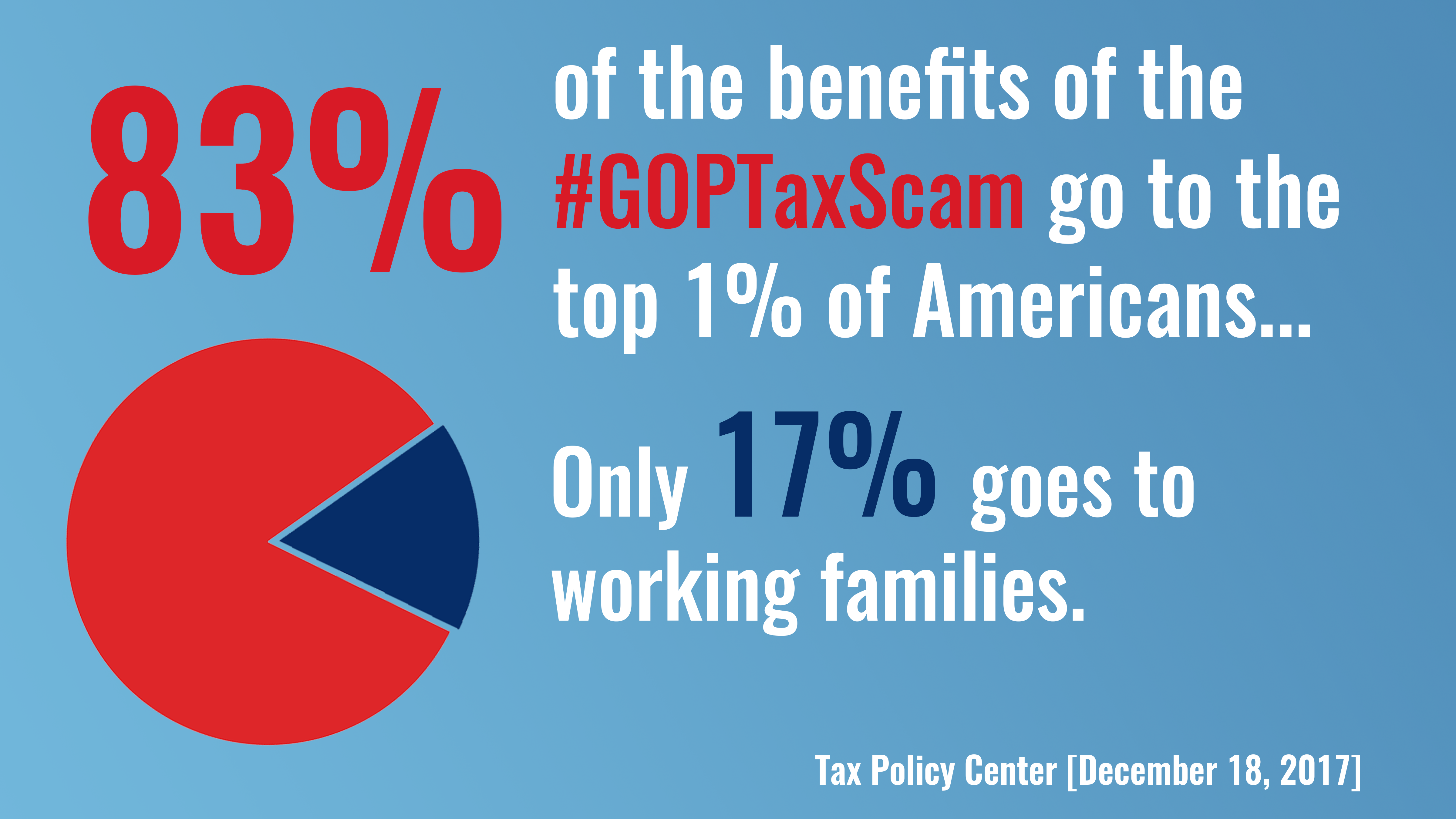

Instead of working with Democrats on bipartisan, comprehensive tax reform, Republicans enacted partisan legislation that neither helps the middle class nor promotes fiscal responsibility. Their tax law provides massive tax breaks to the wealthy and big corporations while raising taxes on everyone else after the first few years. 83% of the benefits of this law go to the wealthy and corporations; only 17% goes to working families. Moreover, the GOP tax law contributes to raising the deficit by more than a trillion dollars every year for the next decade.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Related

This morning, the New York Times highlights the profound impact that the GOP tax scam will have on every aspect of American life.

As the Senate begins debate on the Floor on the GOP tax scam – which will affect every American – there’s still a lot that we don’t know about the Senate bill.

Even those behind the GOP tax scam believe this bill will leave middle-class Americans behind. In a Politico Money podcast released this morning, Larry Kudlow admitted that the GOP tax scam will “hurt a lot of different people.” Read it here:

Well, I thank very much, the gentleman from Connecticut for his comments, in particular, highlighting how the majority party, considering this legislation, cut out the public entirely.

It seems every day that President Trump is breaking another promise to middle-class families.

It’s as if the GOP leadership team is playing Whac-A-Mole today – every time they add a provision to win over a Senator, it causes them to lose another.

Republicans on the Senate Budget Committee have cast their votes for a dangerous and partisan bill that would raise taxes on 82 million middle class families and force our children and grandchildren deeper into debt while giving away the largest tax cuts to the wealthiest in our country.

This week, Senate Republicans are expected to bring their tax bill to the Floor.

With lots of news happening, just a quick reminder that Republicans are still trying to jam through the Senate a tax scam bill that raises taxes on 82 million middle-class households and cuts taxes on the wealthy while adding $1.5 trillion to the deficit.