GOP Tax Law

Republican Tax Law Shortchanges Workers & Our Economy

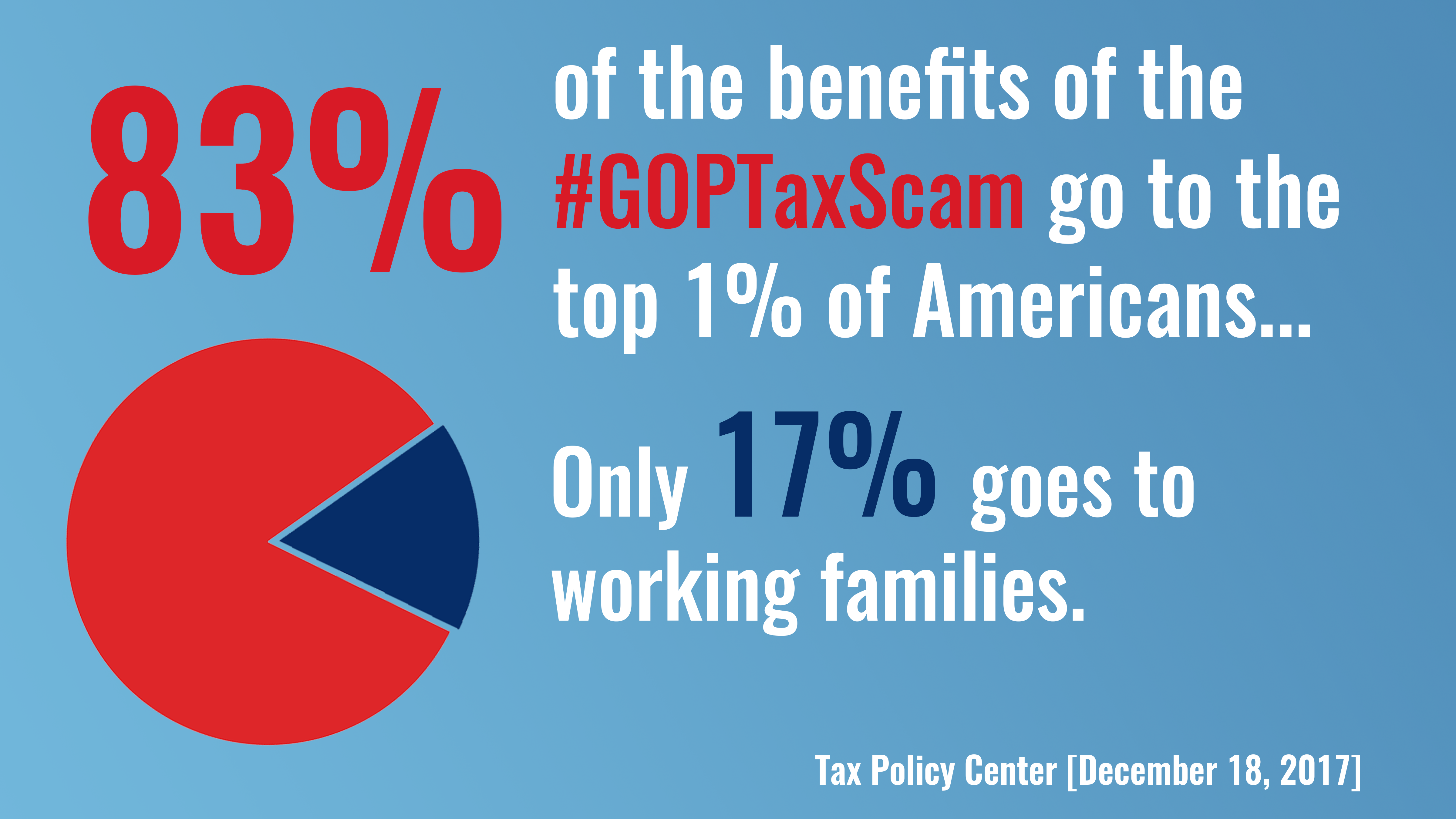

Instead of working with Democrats on bipartisan, comprehensive tax reform, Republicans enacted partisan legislation that neither helps the middle class nor promotes fiscal responsibility. Their tax law provides massive tax breaks to the wealthy and big corporations while raising taxes on everyone else after the first few years. 83% of the benefits of this law go to the wealthy and corporations; only 17% goes to working families. Moreover, the GOP tax law contributes to raising the deficit by more than a trillion dollars every year for the next decade.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Related

Yesterday, House Republicans released their bill to cut taxes for the wealthiest Americans while leaving middle class families behind.

As Republicans prepare to markup their tax bill – without holding any hearings or receiving input from the public – here’s a look at a number of deductions that middle-class families rely on that would be changed:

Republicans have spent months promising that their tax bill would be all about the middle class.

The American people don’t want what House Republicans are selling. In an ABC/Washington Post poll out this morning, only 13% of Americans think the GOP tax bill will help the middle class. Not to mention that 60% of Americans believe the plan is a windfall for the wealthiest Americans (which it is).

Read the poll here:

Read the poll here:

This afternoon, the Washington Post put together a handy guide on who wins and who loses under the GOP tax bill.

Obviously, they don’t have the votes for their bill right now.

Add them to the list – Republican Reps. Leonard Lance (NJ-07) and Frank LoBiondo (NJ-02) have come out in opposition to Republicans’ tax bill.

It’s been less than two hours since House Republican leaders held their press conference, and already rank-and-file Members are sending out statements announcing they oppose the tax bill.