GOP Tax Law

Republican Tax Law Shortchanges Workers & Our Economy

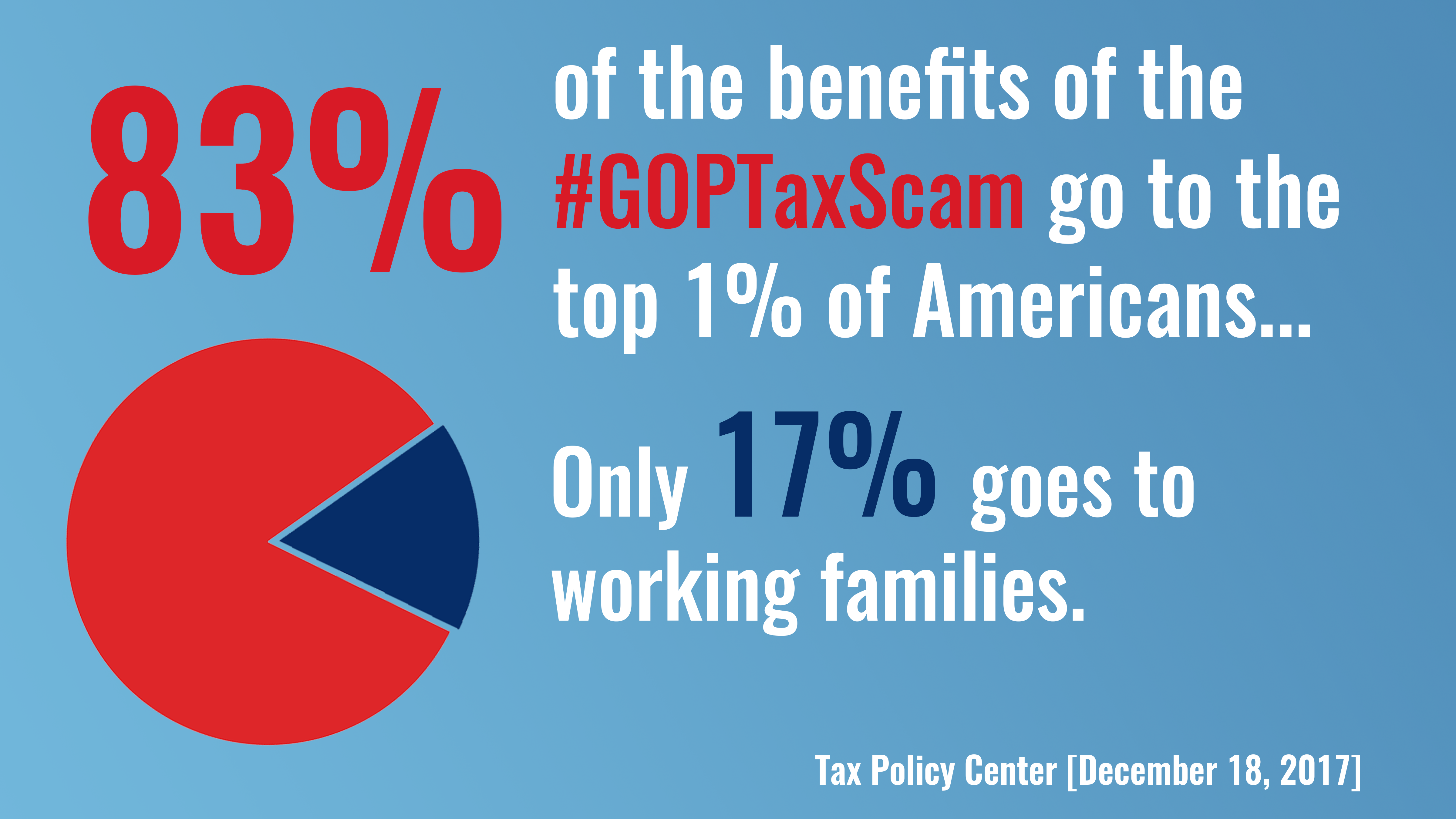

Instead of working with Democrats on bipartisan, comprehensive tax reform, Republicans enacted partisan legislation that neither helps the middle class nor promotes fiscal responsibility. Their tax law provides massive tax breaks to the wealthy and big corporations while raising taxes on everyone else after the first few years. 83% of the benefits of this law go to the wealthy and corporations; only 17% goes to working families. Moreover, the GOP tax law contributes to raising the deficit by more than a trillion dollars every year for the next decade.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Related

Thank you very much, Jim. I want to thank Jim Costa, his predecessors, and present members of the Blue Dogs who have been very focused on the fiscal sustainability of our finances in America and the impact of debt on our country.

Thank you very much, Mr. Chairman.

I think that would be very appropriate [to delay the vote on the tax bill].

Sounds like GOP donors are calling again.

In less than two months, Republicans jammed their tax scam through the House and the Senate and are now writing the conference report in secret, behind closed doors.

Another day, another story about how Republicans are breaking the promises they made to the American people.

This ‘analysis’ by the Treasury Department is a new low for putting politics over policy. It should surprise no one that the Trump Administration, in its desperation to justify the Republican tax scam, issued a one-page document assuming the President’s promised level of growth without any justification.

The USA Today Editorial Board had some cautionary words for the GOP today on their unpopular tax scam that raises taxes on 78 million Americans, takes health care away from 13 million, and adds $1.7 trillion to the national debt in order to give tax cuts to the wealthiest Americans and corporations.

Republican leaders can repeat the words regular order until they are blue in the face, but a look at the process they are pursuing to jam the GOP tax scam through Congress shows it’s anything but and their rush to pass a bill means it is riddled with errors and “questionable special-interest provisions.”

Yesterday, House Republicans passed a short-term bill to fund the government for two weeks.