GOP Tax Law

Republican Tax Law Shortchanges Workers & Our Economy

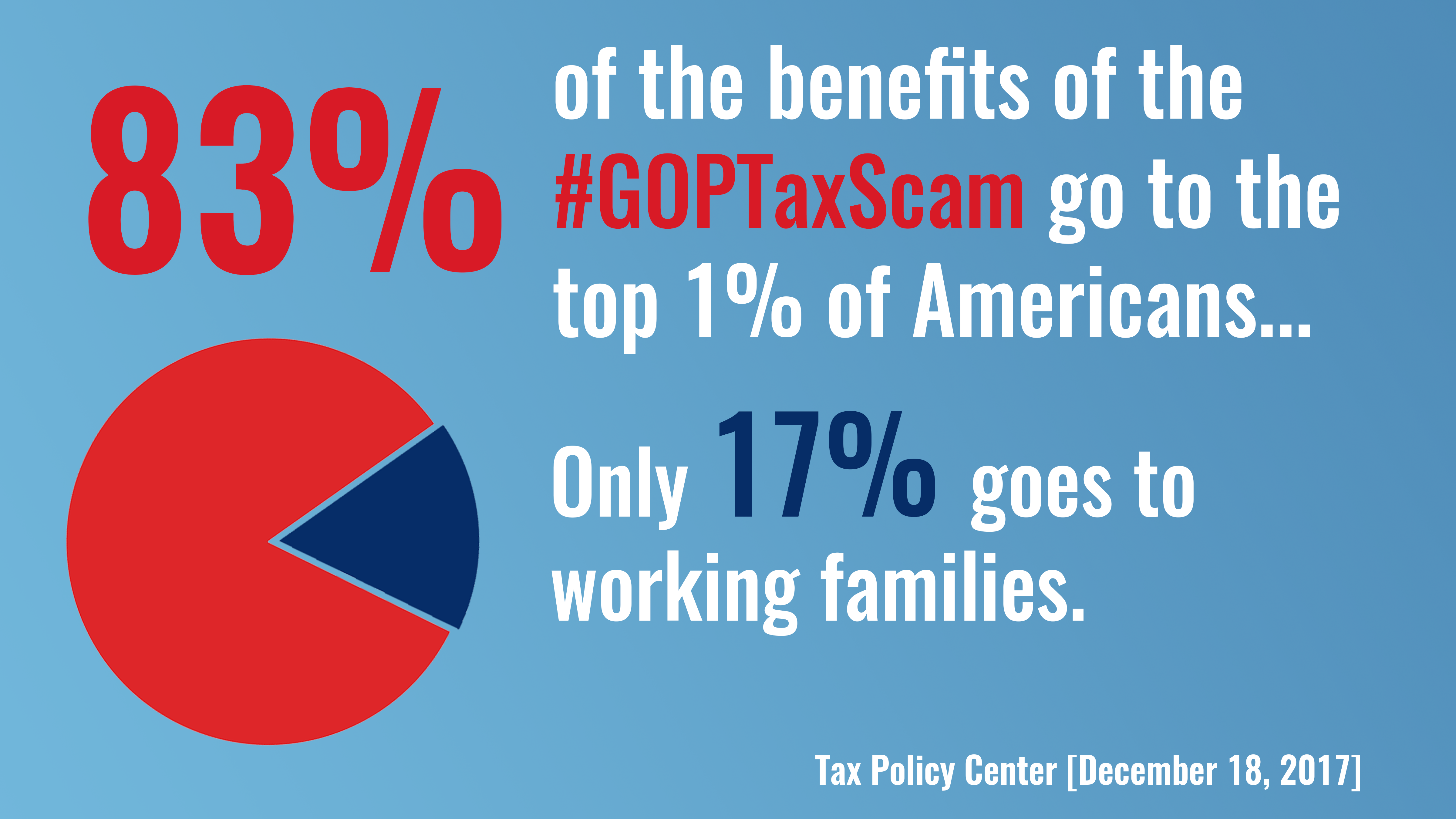

Instead of working with Democrats on bipartisan, comprehensive tax reform, Republicans enacted partisan legislation that neither helps the middle class nor promotes fiscal responsibility. Their tax law provides massive tax breaks to the wealthy and big corporations while raising taxes on everyone else after the first few years. 83% of the benefits of this law go to the wealthy and corporations; only 17% goes to working families. Moreover, the GOP tax law contributes to raising the deficit by more than a trillion dollars every year for the next decade.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Republicans jammed their legislation through Congress without hearings or allowing Americans to provide input about how it shortchanges middle-class families. Now that it has been enacted, everyone can see that it hasn’t dramatically benefited the middle class or small businesses and that it’s bringing further strain to our nation’s finances, which Republicans will use to justify slashing Social Security, Medicare, and Medicaid.

Democrats will continue working to promote the principles of fair, bipartisan tax policies that benefit the middle class and don’t explode the deficit. Furthermore, as Republicans now turn to their plan to gut Social Security, Medicare, and Medicaid in order to offset the deficits their tax law created, Democrats will stand firm in defending these programs so they can benefit Americans today and in the future.

Related

Guess what happens when you rush a bill to give tax cuts to the wealthy through Congress with virtually no time for Members and the public to review it?

Guess who isn’t seeing an increase in their paychecks under the GOP tax scam? The middle class.

It’s Valentine’s Day and we here in the ever-imaginative Democratic Whip Press Shop are in the holiday spirit!

This week, the chaos and dysfunction of the Republican-led Congress was on full display.

This weekend, House Speaker Paul Ryan bragged that a public high school secretary would earn an extra $1.50 as a result of the GOP tax law

Republicans argue that Americans will see the impact of their GOP tax scam law this month (deleted tweets aside)— they’re right, but not for the reasons they would hope. This weekend’s Washington Post highlights how the Trump Administration is on track to borrow nearly $1 trillion this year – the highest amount of borrowing in six years – due to the GOP tax law.

I don't think $1,000 is chump change, Neil but when you compare it to what the upper 1% got, you're talking about $23 a week versus about $1,100 a week [of a tax cut].

President Trump will deliver his first State of the Union address tonight, and as we reflect on his first year in office, it is clear that the Trump presidency has so far been defined by chaos and incompetence.

One thing we’re guessing Republicans didn’t think through before they shut down the government: the IRS won’t be able to implement the tax law that they wasted so much time on instead of funding the government.

Republicans spent the last three months of 2017 ignoring the priorities of the American people to jam their tax bill through Congress.